The balancing act of pay adjustment

Mimi Hough - There is no doubt that 2020 hasn’t been a forgiving and very prosperous year to date.

Companies are continually challenged with remunerating responsibly in light of the economic challenges.

Organisations are confronted with the balancing act of maintaining a sustainable, affordable wage bill, whilst sustaining a remuneration philosophy which can still attract, motivate and retain the required talent.

At some stage during 2020 all organisations are faced with the decision whether annual salary adjustments are viable and affordable, taking into consideration current inflation statistics, employee demands and change in working conditions to name but a few.

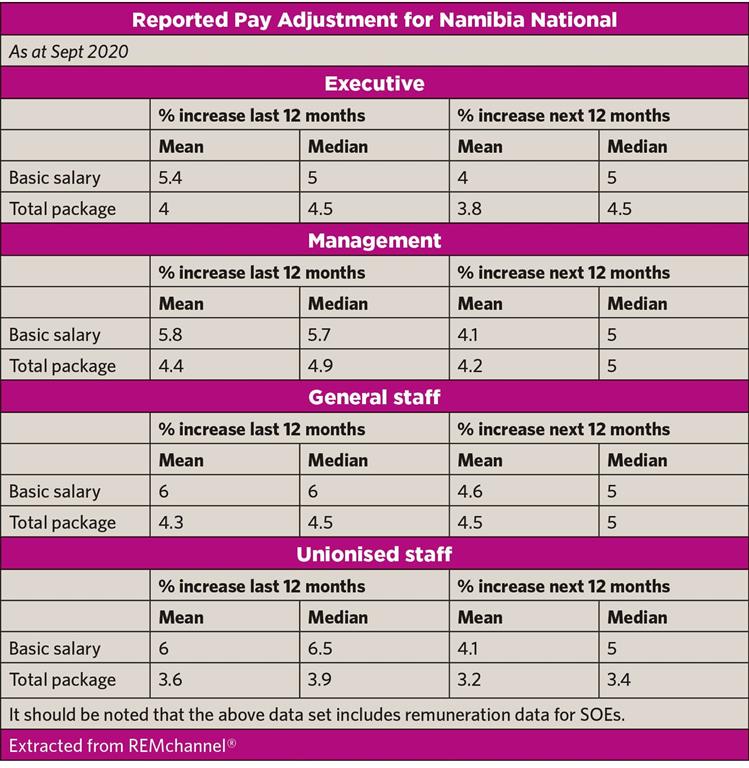

The remuneration and reward team at PwC Namibia consults in a wide variety of remuneration related challenges and this specifically includes the analyses and review of annual pay adjustments within the overall Namibian market or within specified industry sectors. This enables us to advise companies and organisations on the market trends and pay adjustment statistics, with the use of REMchannel® - Namibia’s largest Online Salary Survey.

LOCKDOWN

Since the inception of lockdown in Namibia and the effect thereof on the overall economy, we’ve been monitoring the remuneration market statistics for identifiable trends, along with the current inflation and how these multitude of factors are affecting pay adjustments.

The consumer price index (CPI) for August 2020 was reported to be 2.4%. The average CPI over the past 6 months is at 2.1% and the average CPI over the past 12 months is 2.4%.

The drive behind annual pay adjustment is normally closely correlated with CPI but is normally not the only factor influencing salary adjustments. Various factors like union negotiations, individual and company performance, economic forecasts, affordability, industry comparisons and benchmarking, whether internally or externally all drive the annual increase decisions. And let’s not forget about the changes to the national repo rate.

DIFFERENT

However, 2020 is proving to be different.

Some organisations may argue the low CPI does not warrant for a cost of living adjustment and will merely defer any pay adjustment for 2020 until a later date, when the business and economy stabilise.

Numerous organisations just can’t afford a salary adjustment due to the severe impact of Covid-19 on the business or the industry. Other companies, who can actually afford increases, may merely adjust their mandatory budget increases to align with CPI, providing the minimum annual increase.

We’ve been monitoring increments granted in the overall market since February 2020, and we’ve noted a steady decline in the percentage granted by approximately 1.5%. During February increments ranged from 4 – 6.5% and now during August the range is 3-5%.

From the current trend, we do not expect to see a significant upward inclination towards the end of 2020.

We hope this information will provide you with an actual view of what’s happening with pay adjustments in Namibia to assist with your salary review consideration for 2020.

Mimi Hough is a senior manager at PwC Namibia. Contact her at [email protected]

Companies are continually challenged with remunerating responsibly in light of the economic challenges.

Organisations are confronted with the balancing act of maintaining a sustainable, affordable wage bill, whilst sustaining a remuneration philosophy which can still attract, motivate and retain the required talent.

At some stage during 2020 all organisations are faced with the decision whether annual salary adjustments are viable and affordable, taking into consideration current inflation statistics, employee demands and change in working conditions to name but a few.

The remuneration and reward team at PwC Namibia consults in a wide variety of remuneration related challenges and this specifically includes the analyses and review of annual pay adjustments within the overall Namibian market or within specified industry sectors. This enables us to advise companies and organisations on the market trends and pay adjustment statistics, with the use of REMchannel® - Namibia’s largest Online Salary Survey.

LOCKDOWN

Since the inception of lockdown in Namibia and the effect thereof on the overall economy, we’ve been monitoring the remuneration market statistics for identifiable trends, along with the current inflation and how these multitude of factors are affecting pay adjustments.

The consumer price index (CPI) for August 2020 was reported to be 2.4%. The average CPI over the past 6 months is at 2.1% and the average CPI over the past 12 months is 2.4%.

The drive behind annual pay adjustment is normally closely correlated with CPI but is normally not the only factor influencing salary adjustments. Various factors like union negotiations, individual and company performance, economic forecasts, affordability, industry comparisons and benchmarking, whether internally or externally all drive the annual increase decisions. And let’s not forget about the changes to the national repo rate.

DIFFERENT

However, 2020 is proving to be different.

Some organisations may argue the low CPI does not warrant for a cost of living adjustment and will merely defer any pay adjustment for 2020 until a later date, when the business and economy stabilise.

Numerous organisations just can’t afford a salary adjustment due to the severe impact of Covid-19 on the business or the industry. Other companies, who can actually afford increases, may merely adjust their mandatory budget increases to align with CPI, providing the minimum annual increase.

We’ve been monitoring increments granted in the overall market since February 2020, and we’ve noted a steady decline in the percentage granted by approximately 1.5%. During February increments ranged from 4 – 6.5% and now during August the range is 3-5%.

From the current trend, we do not expect to see a significant upward inclination towards the end of 2020.

We hope this information will provide you with an actual view of what’s happening with pay adjustments in Namibia to assist with your salary review consideration for 2020.

Mimi Hough is a senior manager at PwC Namibia. Contact her at [email protected]

Comments

Namibian Sun

No comments have been left on this article