Poor report card for !Gawaxab

A leading global index rating how effective central bank chiefs use tools to mitigate a pandemic-ridden world has found the Bank of Namibia governor lagging behind his peers.

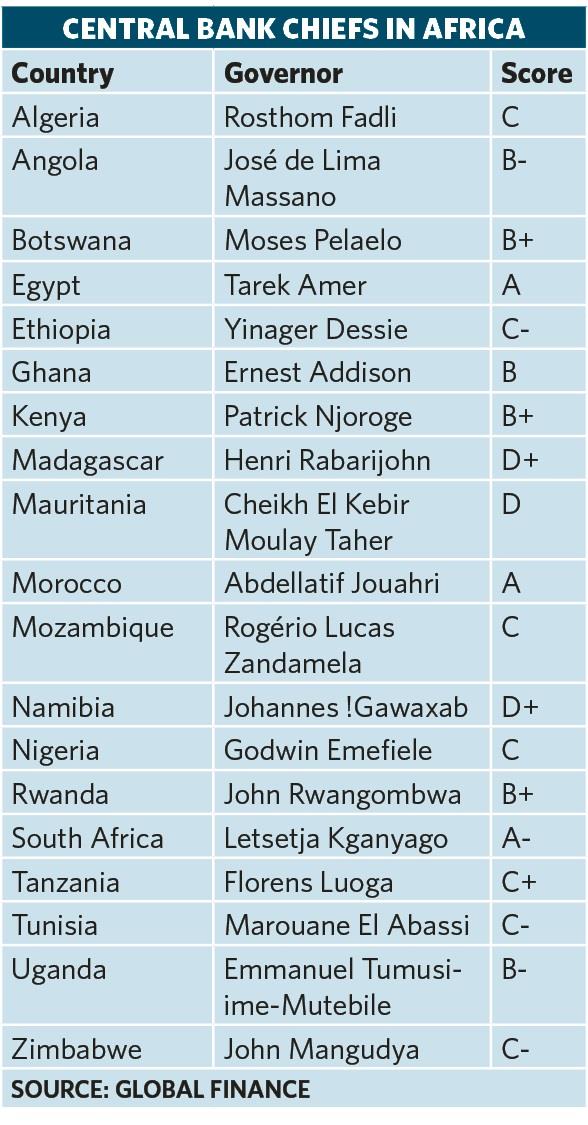

Jo-Maré Duddy – The governor of the Bank of Namibia (BoN), Johannes !Gawaxab, is ranked under the five worst central bank chiefs in 100 countries rated by the leading Global Finance magazine.

!Gawaxab received a D+ in Global Finance’s Central Banker Report Cards 2021, which rates performance from A (best) to F (worst).

This is !Gawaxab’s debut on the Global Finance index since he became governor of the BoN in June 2020. With the 2021 ranking, !Gawaxab finds himself in the company of Henri Rabarijohn (D+) of the central bank of Madagascar, Cheikh El Kebir Moulay Taher (D) from Mauritania, Miguel Ángel Pesce (F) from Argentina and Calixto Ortega (F) from Venezuela.

This is the worst performance of a BoN chief since Namibia’s inclusion in Global Finance annual index in 2015.

!Gawaxab took over the BoN’s reins from Iipumbu Shiimi, who was governor from 2010 until he became the minister of finance in 2020. Throughout his tenure as BoN chief, Shiimi score ranged from B- to B, except for 2019 and the first half of 2020, when he received a C+.

Namibia is part of the Common Monetary Area (CMA) and its currency is pegged to the South African rand. As such, the BoN often takes its monetary policy cue from the South African Reserve Bank (SARB). In contrast to !Gawaxab’s performance, SARB governor Lesetja Kganyago scored an A- in Global Finance’s latest report.

POWERFUL AUDIENCE

“The last year kept central bank governors on high alert, as a global health crisis threatened fiscal as well as physical health. Although years of loose money left some with little room to add stimulus, central bankers used all the tools at their disposal to mitigate the immediate threat,” Global Finance says in its latest report.

Global Finance editors, with input from analysts, economists and financial industry sources, grade the world’s leading central bankers based on a series of objective and subjective metrics, including the appropriate implementation of monetary policy for the economic conditions of each country.

Headquartered in New York, the magazine’s audience includes chairpersons, presidents, CEOs, chief financial officers, treasurers and other senior financial officers responsible for making investment and strategic business decisions at multinational companies and financial institutions.

‘CAUTIOUS APPROACH’

“More than a year after he took over as governor, !Gawaxab continues to adopt a cautious approach in monetary policy,” Global Finance says.

The BoN’s repo rate has been kept unchanged at 3.75% since August 2020 to support country’s weak economy and to safeguard the one-to-one link between the Namibia dollar and the South African rand.

Global Finance points out that the Covid-19 pandemic has had “extensive advance impacts” on the economy, with key sectors like tourism, mining, agriculture, manufacturing and construction “badly ravaged”.

“The triple effects have been a significant decline in banking industry profits and a surge in NPLs [non-performing loans],” the magazine says.

FINANCIAL STABILITY

The BoN’s last Financial Stability Report (FSR), issued in April 2021, stated that the banking sector’s after-tax profits fell by 33.4% to N$1.8 billion in 2020 from N$2.7 billion in 2019.

According to BoN statistics, NPLs comprised 4.6% of total gross loans of the banking sector at the end of 2019. At the end of 2020, it was 6.4% - surpassing the trigger point of 6.0% in crisis times. The situation deteriorated further in 2021: from 6.5% in the first quarter to 6.6% the next and 6.8% in the third quarter. Data for the last quarter of 2021 is not yet available.

Global Finance says “concerns over the stability of the [banking] industry has forced the BoN to heightened credit risk monitoring and carry out stress tests”.

The stress test scenarios painted in the April FSP showed an increase of two percentage points from 6.44% in the baseline scenario, three percentage points in a moderate one and five percentage points in a severe case.

!Gawaxab received a D+ in Global Finance’s Central Banker Report Cards 2021, which rates performance from A (best) to F (worst).

This is !Gawaxab’s debut on the Global Finance index since he became governor of the BoN in June 2020. With the 2021 ranking, !Gawaxab finds himself in the company of Henri Rabarijohn (D+) of the central bank of Madagascar, Cheikh El Kebir Moulay Taher (D) from Mauritania, Miguel Ángel Pesce (F) from Argentina and Calixto Ortega (F) from Venezuela.

This is the worst performance of a BoN chief since Namibia’s inclusion in Global Finance annual index in 2015.

!Gawaxab took over the BoN’s reins from Iipumbu Shiimi, who was governor from 2010 until he became the minister of finance in 2020. Throughout his tenure as BoN chief, Shiimi score ranged from B- to B, except for 2019 and the first half of 2020, when he received a C+.

Namibia is part of the Common Monetary Area (CMA) and its currency is pegged to the South African rand. As such, the BoN often takes its monetary policy cue from the South African Reserve Bank (SARB). In contrast to !Gawaxab’s performance, SARB governor Lesetja Kganyago scored an A- in Global Finance’s latest report.

POWERFUL AUDIENCE

“The last year kept central bank governors on high alert, as a global health crisis threatened fiscal as well as physical health. Although years of loose money left some with little room to add stimulus, central bankers used all the tools at their disposal to mitigate the immediate threat,” Global Finance says in its latest report.

Global Finance editors, with input from analysts, economists and financial industry sources, grade the world’s leading central bankers based on a series of objective and subjective metrics, including the appropriate implementation of monetary policy for the economic conditions of each country.

Headquartered in New York, the magazine’s audience includes chairpersons, presidents, CEOs, chief financial officers, treasurers and other senior financial officers responsible for making investment and strategic business decisions at multinational companies and financial institutions.

‘CAUTIOUS APPROACH’

“More than a year after he took over as governor, !Gawaxab continues to adopt a cautious approach in monetary policy,” Global Finance says.

The BoN’s repo rate has been kept unchanged at 3.75% since August 2020 to support country’s weak economy and to safeguard the one-to-one link between the Namibia dollar and the South African rand.

Global Finance points out that the Covid-19 pandemic has had “extensive advance impacts” on the economy, with key sectors like tourism, mining, agriculture, manufacturing and construction “badly ravaged”.

“The triple effects have been a significant decline in banking industry profits and a surge in NPLs [non-performing loans],” the magazine says.

FINANCIAL STABILITY

The BoN’s last Financial Stability Report (FSR), issued in April 2021, stated that the banking sector’s after-tax profits fell by 33.4% to N$1.8 billion in 2020 from N$2.7 billion in 2019.

According to BoN statistics, NPLs comprised 4.6% of total gross loans of the banking sector at the end of 2019. At the end of 2020, it was 6.4% - surpassing the trigger point of 6.0% in crisis times. The situation deteriorated further in 2021: from 6.5% in the first quarter to 6.6% the next and 6.8% in the third quarter. Data for the last quarter of 2021 is not yet available.

Global Finance says “concerns over the stability of the [banking] industry has forced the BoN to heightened credit risk monitoring and carry out stress tests”.

The stress test scenarios painted in the April FSP showed an increase of two percentage points from 6.44% in the baseline scenario, three percentage points in a moderate one and five percentage points in a severe case.

Comments

Namibian Sun

No comments have been left on this article