No policy on Chinese engagements

Namibia is yet to develop its own framework to guide its engagement with the rising superpower.

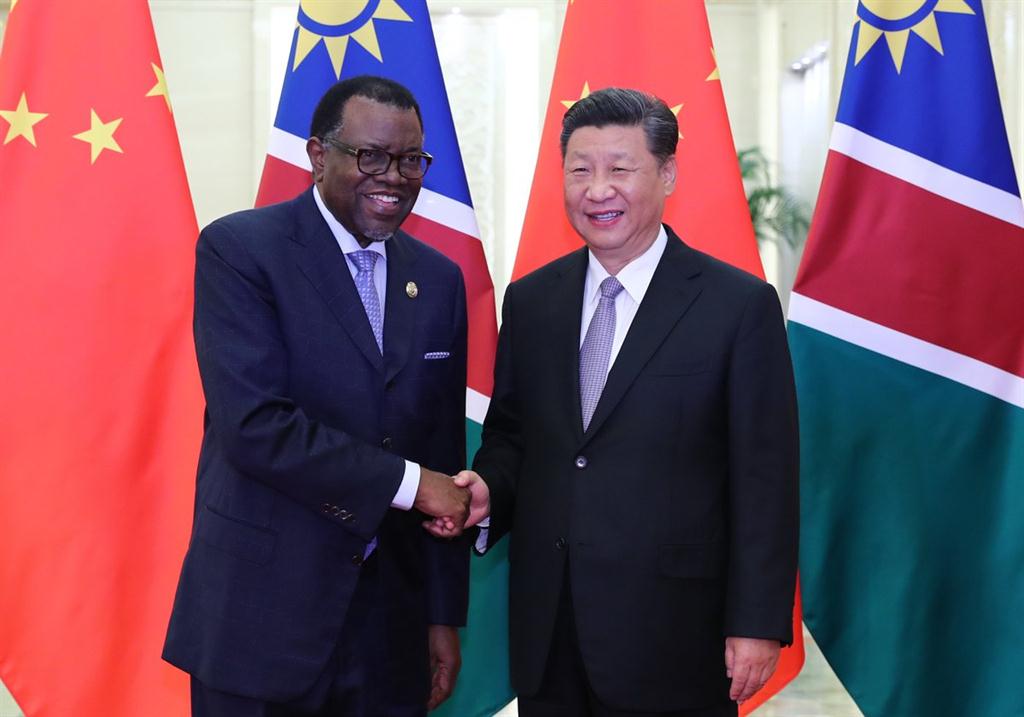

Despite its growing political engagement, exponential increase in trade, and sizable public works contracts being awarded to Chinese companies, the Namibian government has not produced any clear policy outline or strategy regarding cooperation with China.

This is the conclusion reached by researchers Dietrich Remmert and Rakkel Andreas of the Institute for Public Policy Research (IPPR) in their briefing paper 'Risks and Rewards: Making Sense of Namibia-China Relations', which was launched last week.

The researchers say while the Namibian government's engagement with China is “extensive, overtly friendly”, it can also be argued that it is “lacking in caution” and “critical reflection or strategy”.

The researchers say what is woefully missing from this picture is clear and unambiguous data, and how this is related to the Namibian public.

Investments in Africa, Namibia

Concerns are growing over the debt status of developing nations and China's role.

It is estimated that China currently holds debt from developing and emerging markets amounting to US$360 billion, compared to the US$246 billion held by the Paris Club, which are the 22 major international lenders, including the USA, Germany, and Japan.

Yet, Africa's external debt is not held by China; 35% of the continent's public debt is owed to international institutions like the International Monetary Fund (IMF) and the World Bank.

Past annual trade statistics published by the Namibia Statistics Agency (NSA) showed that Namibia imported more from China than what it exported. This changed in 2018, when Namibia recorded a trade surplus of just over N$10 billion with China.

In 2018 China became the top export destination for Namibia, amounting to 18% of all its exports, outpacing Botswana and South Africa.

The bulk of these exports consisted of copper that had been imported from Zambia, which means that much of the economic value, like mining jobs and tax revenue from mining activities, is located outside Namibia, the researchers state.

Namibia exports mainly uranium oxide to China, and imports primarily manufactured goods like industrial and electrical machinery, iron or steel articles, motor vehicles and aircraft.

Investment from China has mostly been in the extractive and construction sectors.

Namibia-China debt issues

The Namibian government has denied that it has borrowed unsustainably from China. In September 2018 finance minister Calle Schlettwein said Namibia's debt to China was about N$2 billion, or 2.6% of the total national debt.

Inexplicably, however, Schlettwein in May 2019 said bilateral loans from China and Namibia amounted to N$1.19 billion, or around 1% of Namibia's total debt - a significant drop in less than a year.

Furthermore, in March this year, the ministry said Namibia owed just over N$2 billion in Yuan, China's currency.

Chinese SMEs in Namibia

A visible growing trend is the increase of Chinese small and medium enterprises (SMEs) in Namibia, but the IPPR researchers say very little official data is available on these.

The Business and Intellectual Property Authority (BIPA) said in August that about 1 176 businesses here were either owned by Chinese nationals or had Chinese shareholding. However, it is not clear what activities half of these – or 606 – are engaged in.

The rest are said to be engaged in services, property and real estate, wholesale and retail, the latter including catering and accommodation services. Only a few are said to be in manufacturing, commerce and the construction industry.

The IPPR researchers say it remains difficult to establish the economic and social impact of these Chinese shops, although earlier labour researchers concluded that the small shops had little benefit for Namibia's overall development.

The Polytechnic of Namibia researchers in 2009 said Chinese investment did not necessarily result in negative consequences for local citizens or businesses, maintaining that stiff competition would force local companies to become more effective and productive.

The Namibian government's position on this is clear: while local companies in the retail and construction sectors expect support and industry protection, government argues that it needs to attract foreign investment to grow the economy.

CATHERINE SASMAN

This is the conclusion reached by researchers Dietrich Remmert and Rakkel Andreas of the Institute for Public Policy Research (IPPR) in their briefing paper 'Risks and Rewards: Making Sense of Namibia-China Relations', which was launched last week.

The researchers say while the Namibian government's engagement with China is “extensive, overtly friendly”, it can also be argued that it is “lacking in caution” and “critical reflection or strategy”.

The researchers say what is woefully missing from this picture is clear and unambiguous data, and how this is related to the Namibian public.

Investments in Africa, Namibia

Concerns are growing over the debt status of developing nations and China's role.

It is estimated that China currently holds debt from developing and emerging markets amounting to US$360 billion, compared to the US$246 billion held by the Paris Club, which are the 22 major international lenders, including the USA, Germany, and Japan.

Yet, Africa's external debt is not held by China; 35% of the continent's public debt is owed to international institutions like the International Monetary Fund (IMF) and the World Bank.

Past annual trade statistics published by the Namibia Statistics Agency (NSA) showed that Namibia imported more from China than what it exported. This changed in 2018, when Namibia recorded a trade surplus of just over N$10 billion with China.

In 2018 China became the top export destination for Namibia, amounting to 18% of all its exports, outpacing Botswana and South Africa.

The bulk of these exports consisted of copper that had been imported from Zambia, which means that much of the economic value, like mining jobs and tax revenue from mining activities, is located outside Namibia, the researchers state.

Namibia exports mainly uranium oxide to China, and imports primarily manufactured goods like industrial and electrical machinery, iron or steel articles, motor vehicles and aircraft.

Investment from China has mostly been in the extractive and construction sectors.

Namibia-China debt issues

The Namibian government has denied that it has borrowed unsustainably from China. In September 2018 finance minister Calle Schlettwein said Namibia's debt to China was about N$2 billion, or 2.6% of the total national debt.

Inexplicably, however, Schlettwein in May 2019 said bilateral loans from China and Namibia amounted to N$1.19 billion, or around 1% of Namibia's total debt - a significant drop in less than a year.

Furthermore, in March this year, the ministry said Namibia owed just over N$2 billion in Yuan, China's currency.

Chinese SMEs in Namibia

A visible growing trend is the increase of Chinese small and medium enterprises (SMEs) in Namibia, but the IPPR researchers say very little official data is available on these.

The Business and Intellectual Property Authority (BIPA) said in August that about 1 176 businesses here were either owned by Chinese nationals or had Chinese shareholding. However, it is not clear what activities half of these – or 606 – are engaged in.

The rest are said to be engaged in services, property and real estate, wholesale and retail, the latter including catering and accommodation services. Only a few are said to be in manufacturing, commerce and the construction industry.

The IPPR researchers say it remains difficult to establish the economic and social impact of these Chinese shops, although earlier labour researchers concluded that the small shops had little benefit for Namibia's overall development.

The Polytechnic of Namibia researchers in 2009 said Chinese investment did not necessarily result in negative consequences for local citizens or businesses, maintaining that stiff competition would force local companies to become more effective and productive.

The Namibian government's position on this is clear: while local companies in the retail and construction sectors expect support and industry protection, government argues that it needs to attract foreign investment to grow the economy.

CATHERINE SASMAN

Comments

Namibian Sun

No comments have been left on this article