Company news in brief

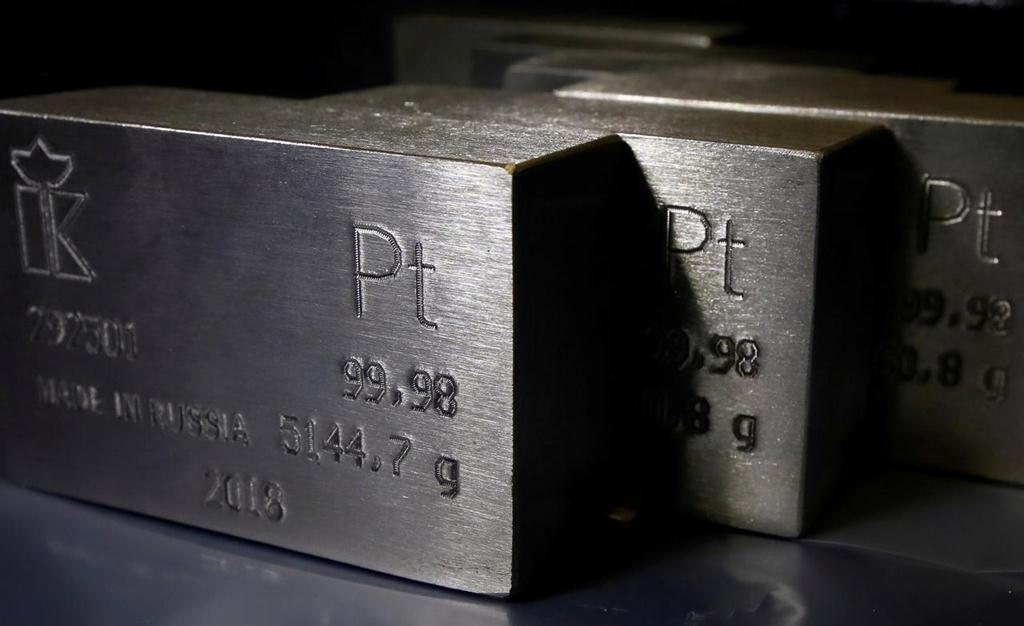

Amplats names new CEO

Anglo American Platinum (Amplats) yesterday appointed industry veteran Natascha Viljoen as chief executive officer, replacing Chris Griffith whose departure was announced earlier this week.

Viljoen, who has served as the group head of processing at parent company Anglo American since 2014, will take on the role from April 16 and joins Amplats at a time when higher metals prices have boosted the company's earnings.

The 49-year old previously held roles at Lonmin, AngloGold and BHP and started her career in 1991 at ArcelorMittal South Africa as a trainee engineer.

Griffith, who has led the company since 2012, said earlier this week he did not yet have plans for what he would do next and would not rule out a career outside mining.

He headed Amplats during a turnaround plan to cut production and costs in response to platinum prices, which then were depressed. – Nampa/Reuters

Petrobras hits all-time profit record

Brazilian state-run oil firm Petrobras missed fourth-quarter expectations, but posted a record profit for 2019, as the firm's strategy of focusing on deepwater production and exiting non-core activities shows signs off paying off.

In a securities filing on Wednesday, Petroleo Brasileiro SA, as the company is formally known, said full-year 2019 profit came to 40.1 billion reais (US$9.19 billion), the highest figure ever.

The company posted a quarterly net income of 8.15 billion reais, significantly below some analysts' expectations, as the firm was dogged by impairments and an increase in administrative costs. Analysts at Brazilian investment bank BTG Pactual had estimated the firm would report a net income of 9.09 billion reais.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) were 36.5 billion reais in the quarter, which was also at the low end of analysts' estimates.

The firm registered 6.59 billion reais in impairments due to revisions to Brent oil price forecasts, as well as a 2.2 billion-real impairment at its RNEST refinery due to construction delays. – Nampa/Reuters

Airbus defence division to cut jobs

The defence business of Airbus on Wednesday laid out plans to cut more than 2 300 jobs, citing a flat space market and postponed defence contracts.

The aircraft maker said its Airbus Defence and Space division had entered consultation with the company's European works council on the planned cutbacks.

The plan foresees the reduction of 2 362 positions until the end of 2021, of which 829 would be in Germany, 357 in Britain, 630 in Spain, 404 in France and 141 in other countries, according to a statement.

The group has also taken a 1.2 billion euro (US$1.3 billion) charge on the worsening sales outlook, with a German ban on defence exports to Saudi Arabia causing Airbus Defence and Space to lose a promising potential customer, Dirk Hoke said.

Airbus Defence and Space, formed in 2014 as part of a broader restructuring, employs 34 000 staff – 13 000 of them in Germany - and contributes around a fifth of revenues to parent group Airbus. – Nampa/Reuters

Pirelli maps route to margin growth

Italian tyremaker Pirelli will focus on its premium products and cost-cutting measures to drive a gradual increase in core profit margins over the next two years.

Announcing its strategic plan along with annual results on Wednesday, the group said its margin on adjusted earnings before interest and tax (EBIT) would rise to between 18% and 19% through 2022, up from 17.2% last year.

The manufacturer of tyres for Formula One racing teams and high-end carmakers such as BMW and Audi said it planned "significant" increases to production capacity for premium tyres to about 71% of total tyre capacity in 2022, from 65% last year.

Despite weakness in global car production, Pirelli expects to outperform the wider market for premium tyres by about three percentage points over the strategy plan's three-year period, with average annual volume growth of about 9%.

The company said it plans to cut 510 million euro in costs over the next three years, mainly through a review of its product range, component simplification, supplies savings and a planned reorganisation of production in Brazil and at one of its Italian plants. – Nampa/Reuters

Diageo to settle overshipment charges

Diageo Plc agreed to pay a US$5 million civil fine to settle US Securities and Exchange Commission charges that the global liquor company quietly pressured distributors to buy excess inventory to boost its results in a flagging market.

The London-based company - whose brands include Johnnie Walker Scotch whisky, Smirnoff vodka, Tanqueray gin and Guinness beer - did not admit or deny wrongdoing, but agreed to cease and desist from further violations, the SEC said on Wednesday.

According to the SEC, Diageo failed to publicly disclose how employees at its most profitable unit, Diageo North America, pushed distributors in its 2014 and 2015 fiscal years to buy more wine and spirits than they needed.

The SEC said this "overshipping" enabled Diageo to report higher growth in operating profit and net sales than analysts expected, but was unsustainable because distributors would likely eventually push back on orders, and some did.

According to the regulator, Diageo misled investors by leaving them with the impression that normal customer demand was helping fuel its reported growth. – Nampa/Reuters

Anglo American Platinum (Amplats) yesterday appointed industry veteran Natascha Viljoen as chief executive officer, replacing Chris Griffith whose departure was announced earlier this week.

Viljoen, who has served as the group head of processing at parent company Anglo American since 2014, will take on the role from April 16 and joins Amplats at a time when higher metals prices have boosted the company's earnings.

The 49-year old previously held roles at Lonmin, AngloGold and BHP and started her career in 1991 at ArcelorMittal South Africa as a trainee engineer.

Griffith, who has led the company since 2012, said earlier this week he did not yet have plans for what he would do next and would not rule out a career outside mining.

He headed Amplats during a turnaround plan to cut production and costs in response to platinum prices, which then were depressed. – Nampa/Reuters

Petrobras hits all-time profit record

Brazilian state-run oil firm Petrobras missed fourth-quarter expectations, but posted a record profit for 2019, as the firm's strategy of focusing on deepwater production and exiting non-core activities shows signs off paying off.

In a securities filing on Wednesday, Petroleo Brasileiro SA, as the company is formally known, said full-year 2019 profit came to 40.1 billion reais (US$9.19 billion), the highest figure ever.

The company posted a quarterly net income of 8.15 billion reais, significantly below some analysts' expectations, as the firm was dogged by impairments and an increase in administrative costs. Analysts at Brazilian investment bank BTG Pactual had estimated the firm would report a net income of 9.09 billion reais.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) were 36.5 billion reais in the quarter, which was also at the low end of analysts' estimates.

The firm registered 6.59 billion reais in impairments due to revisions to Brent oil price forecasts, as well as a 2.2 billion-real impairment at its RNEST refinery due to construction delays. – Nampa/Reuters

Airbus defence division to cut jobs

The defence business of Airbus on Wednesday laid out plans to cut more than 2 300 jobs, citing a flat space market and postponed defence contracts.

The aircraft maker said its Airbus Defence and Space division had entered consultation with the company's European works council on the planned cutbacks.

The plan foresees the reduction of 2 362 positions until the end of 2021, of which 829 would be in Germany, 357 in Britain, 630 in Spain, 404 in France and 141 in other countries, according to a statement.

The group has also taken a 1.2 billion euro (US$1.3 billion) charge on the worsening sales outlook, with a German ban on defence exports to Saudi Arabia causing Airbus Defence and Space to lose a promising potential customer, Dirk Hoke said.

Airbus Defence and Space, formed in 2014 as part of a broader restructuring, employs 34 000 staff – 13 000 of them in Germany - and contributes around a fifth of revenues to parent group Airbus. – Nampa/Reuters

Pirelli maps route to margin growth

Italian tyremaker Pirelli will focus on its premium products and cost-cutting measures to drive a gradual increase in core profit margins over the next two years.

Announcing its strategic plan along with annual results on Wednesday, the group said its margin on adjusted earnings before interest and tax (EBIT) would rise to between 18% and 19% through 2022, up from 17.2% last year.

The manufacturer of tyres for Formula One racing teams and high-end carmakers such as BMW and Audi said it planned "significant" increases to production capacity for premium tyres to about 71% of total tyre capacity in 2022, from 65% last year.

Despite weakness in global car production, Pirelli expects to outperform the wider market for premium tyres by about three percentage points over the strategy plan's three-year period, with average annual volume growth of about 9%.

The company said it plans to cut 510 million euro in costs over the next three years, mainly through a review of its product range, component simplification, supplies savings and a planned reorganisation of production in Brazil and at one of its Italian plants. – Nampa/Reuters

Diageo to settle overshipment charges

Diageo Plc agreed to pay a US$5 million civil fine to settle US Securities and Exchange Commission charges that the global liquor company quietly pressured distributors to buy excess inventory to boost its results in a flagging market.

The London-based company - whose brands include Johnnie Walker Scotch whisky, Smirnoff vodka, Tanqueray gin and Guinness beer - did not admit or deny wrongdoing, but agreed to cease and desist from further violations, the SEC said on Wednesday.

According to the SEC, Diageo failed to publicly disclose how employees at its most profitable unit, Diageo North America, pushed distributors in its 2014 and 2015 fiscal years to buy more wine and spirits than they needed.

The SEC said this "overshipping" enabled Diageo to report higher growth in operating profit and net sales than analysts expected, but was unsustainable because distributors would likely eventually push back on orders, and some did.

According to the regulator, Diageo misled investors by leaving them with the impression that normal customer demand was helping fuel its reported growth. – Nampa/Reuters

Comments

Namibian Sun

No comments have been left on this article