Vast landscape of opportunity

Nam’s untapped tourism potential

Namibia is highly appealing as a luxury tourism destination, thanks to its unique selling points: it boasts the second-lowest population in the world after Mongolia, the Fish River Canyon is the second-largest canyon on earth, and the Namib is the oldest desert on the planet.

[However,] there is still potential for the country to further capitalise on the growing luxury and eco-tourism trends through increased marketing efforts.

The prospects for high-end tourism are positive over the medium term as luxury goods surveys, such as the Saks Luxury Pulse survey, indicate that consumers are shifting their spending towards travel expenditures rather than luxury goods.

In the medium term, economic growth in key tourism partners of Namibia, including Germany, the US and France, is anticipated to accelerate, thereby enhancing disposable incomes and fostering increased international travel.

PSG Namibia anticipates a gradual decline in the average spot Brent crude oil price over the same period, which is likely to stabilise jet fuel prices and airfares.

Consumer shift

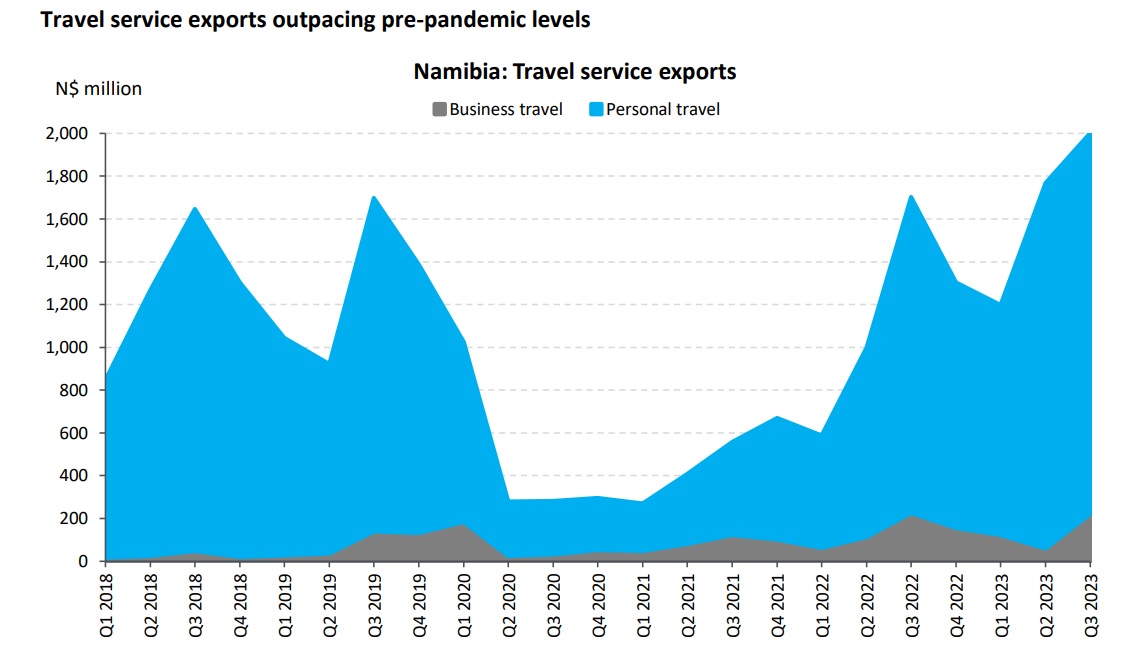

Travel to Namibia is dominated by personal, or leisure, travel as opposed to business travel.

Gitta Paetzold, chief executive of the Hospitality Association of Namibia (HAN), highlights in her remarks on the HAN Statistics for 2023 that the recovery of business and conference travel in terms of room occupancy has not matched that of the leisure travel market.

This can be explained by a shift in consumer preferences, as corporations in recent years have become more comfortable with virtual meetings and more conscious of their carbon footprint.

However, the Bank of Namibia’s (BoN) balance of payments data paints a different picture by showing that international business travel to Namibia in nominal local currency has bounced back.

While this is partly due to a weaker Namibia dollar, it also suggests that foreign business travellers to Namibia are spending more per capita.

Region

The HAN data also shows that the number of beds sold to travellers from Namibia and South Africa in 2023 was only at about 65% of the pre-pandemic level. (To some degree this is due to the lower number of participants in HAN’s survey.)

The weak numbers for local and South African visitors reflect real disposable income growth in these two countries.

South Africa’s economic growth is hampered by structural issues such as power shortages and congested ports, while Namibia’s economic non-mining growth is quite weak.

The HAN tourism accommodation figures seem to suggest that guests from the rest of Africa to Namibia are insignificant, accounting for one per cent of beds sold. However, this is not the case when looking at the data of the Ministry of Environment, Forestry and Tourism. This shows that over 82 000 Angolans, 25 000 Zambians and nearly 20 000 Batswana visited Namibia in 2022.

The discrepancy suggests that most Africans visiting Namibia are either staying in unregulated accommodations or with relatives, while some are also visiting as day visitors.

Europe, US

Europe as an anchor customer to Namibia’s travel industry presents an opportunity in itself, with its affluent travellers who are resilient to economic downturns.

Tourist arrivals from the European Union (EU) and the United States (US) have been robust.

According to Tourism Economics, pent-up savings during the pandemic and favourable exchange rates have encouraged overseas travel from these markets.

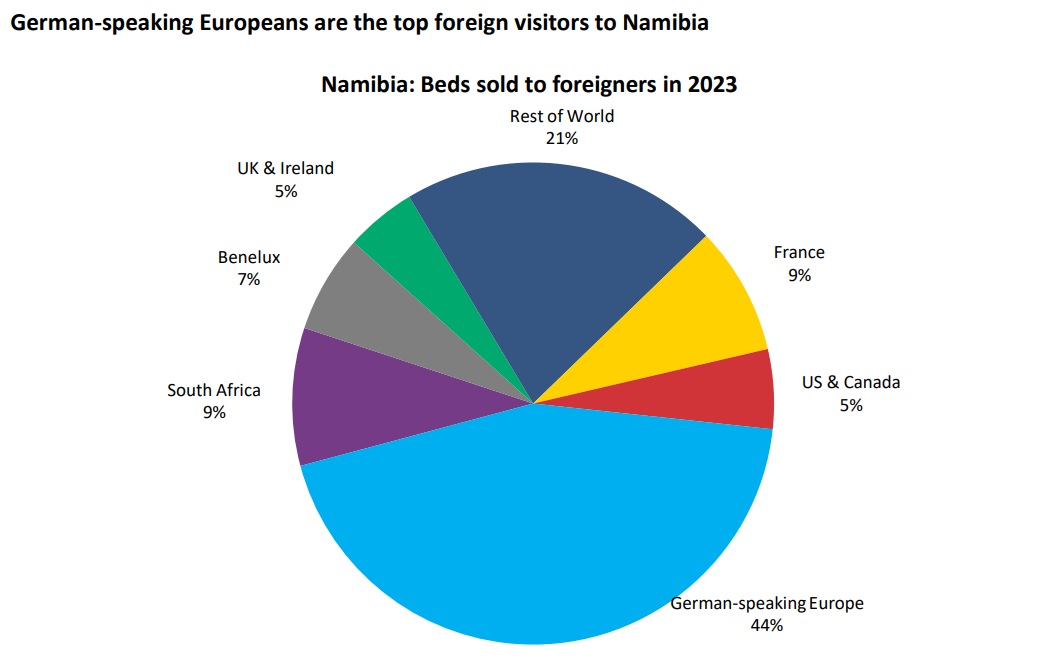

The European market is Namibia’s main source of tourism.

However, travellers from German-speaking Europe - Germany, Switzerland and Austria - traditionally dominate the local tourism market. Namibia has always enjoyed a steady influx of German tourists thanks to its colonial ties to Germany.

Recently, there has been a growing share of visitors from France and Italy, which are the two biggest economies in the EU after Germany. Moreover, France and Italy are effectively in the same time zone as Namibia, which is preferred by some travellers.

The return of Chinese tourists has been remarkably slow, due to China taking longer to lift its Covid-19 restrictions, as well as weakness in the Chinese economy.

Despite typically representing a minimal (1%-2%) share of accommodation bookings in Namibia, the number of beds sold to Chinese guests experienced a sharp decline, dropping from 21 317 in 2019 to 7 389 in 2023.

Popular North

According to the HAN, discussions with industry players suggest that the occupancy figures in the formal hospitality industry do not give a full account of the rising trends of self-drive and camping tourism in the country.

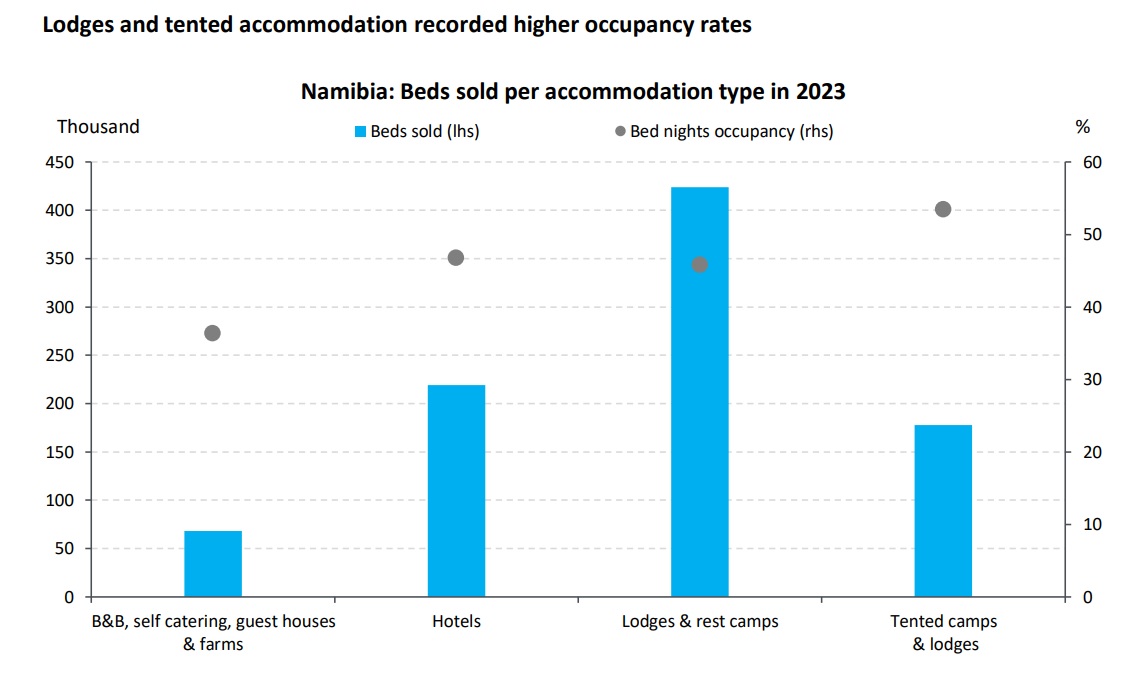

The HAN figures do show that lodges and rest camps sold the most beds in 2023, while tented camps and lodges had the highest occupancy rates.

Moreover, industry players also point to the high-end tourism market gaining popularity in Namibia.

These trends correspond with the global rise in glamping (glamorous camping) and underscore Namibia’s popularity as a destination for watching wildlife. Most of the country’s major wildlife parks are located in its northern region, including Etosha National Park, Bwabwata National Park and Mudumu National Park.

As a result, HAN data shows that most (37%) of the beds sold in Namibia are in the northern region.

Tourism accommodation bookings are evenly distributed among the rest of the regions thanks to each having plenty of unique attractions.

Among many others, the central region has the capital Windhoek and the Waterberg Plateau Park, the southern region has the Orange River and the Fish River Canyon, while the coastal region has Sossusvlei, Dune 7, Kolmanskop and the Skeleton Coast National Park.

Unlocking potential

In terms of unlocking more regional travel, Namibia and Botswana last February reached a landmark agreement to abolish the need for passports when citizens of both countries travel across the Botswana-Namibia border, provided they can produce their IDs at the crossing points.

The move – a first in Southern Africa – could help to promote travel between the two countries.

Furthermore, last September, Namibia launched its online tourist visa application service, which follows the implementation of the visa-upon-arrival pilot project launched in 2019.

Mining vs non-mining

Namibia has recorded exceptional economic growth rates, attributed to its surging mining activity.

Namibia’s mining sector grew by 51.4% year-on-year (y/y) in the first three quarters of 2023, while non-mining sectors only grew by 0.7% y/y. The current mining boom is mainly being driven by strong uranium and gold production and an unprecedented rise in oil and gas exploration activity.

Slow growth in agriculture, construction and manufacturing sectors mostly hampered non-mining gross domestic product (GDP).

The uptick in tourism activity, supporting hotels, restaurants and retail, is boosting non-mining GDP output.

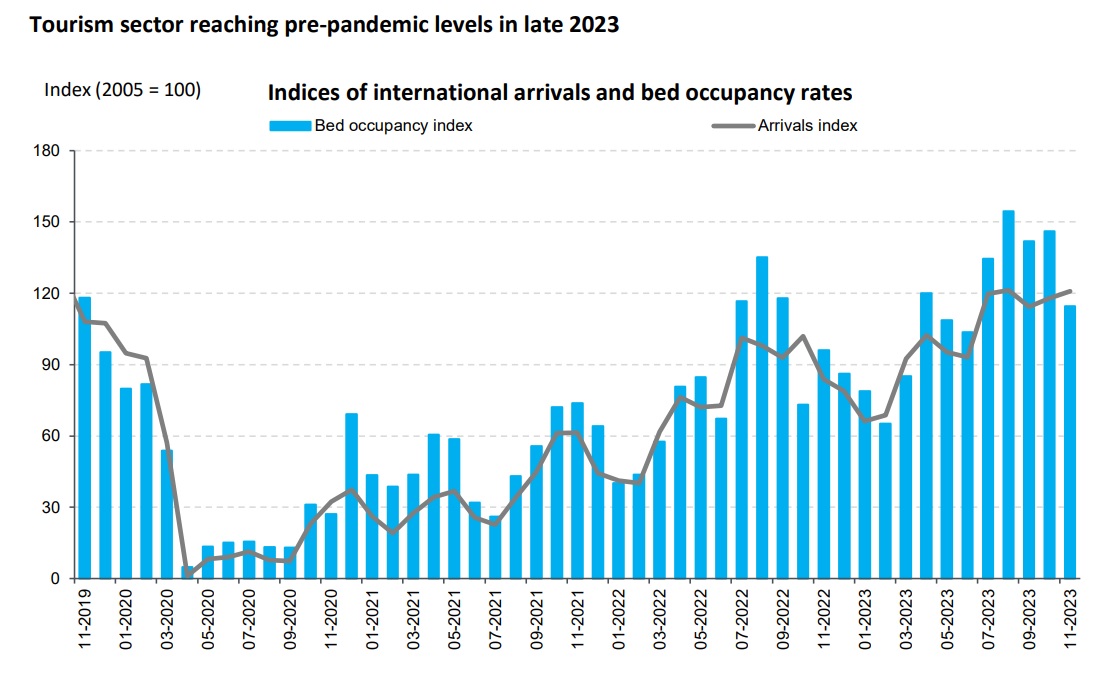

Last year was the first full calendar year without any travel restrictions following the outbreak of Covid-19.

This paved the way for the Namibia Statistics Agency’s (NSA) arrivals index, which measures the level of regional, international and domestic passenger arrivals at Namibian airports, to finally reach pre-pandemic levels in the last quarter of 2023. A clear positive correlation exists between the arrival index and the NSA’s bed occupancy index.

Bigger role

A bigger role for tourism in Namibia would help to diversify the country’s reliance on mining and improve the resilience of economic growth and foreign exchange earnings.

Tourism service is currently Namibia’s fifth biggest export after diamonds, fish, gold and uranium.

Travel service exports accounted for only 8% of total goods and services exports in 2019 - the last year before the pandemic - while mining exports accounted for 39% and processed fish for 15% in the same year.

In 2019, travel and tourism are estimated to have directly contributed 5.6% to Namibia’s GDP, according to Tourism Economics, an Oxford Economics company.

Tourism Economics data also indicated that the Namibian travel and tourism industry supported 39 660 jobs directly in 2019. Although mining and quarrying contributed 10.4% to gross value added (GVA) in 2019, the sector only directly employed 16 432 jobs in the same year, according to the Namibian Chamber of Mines.

This underscores the fact that tourism generates more employment opportunities compared to mining. It also indicates that the tourism sector holds significant potential for fostering job creation in a country grappling with a high broad unemployment rate, which encompasses discouraged job seekers, reaching nearly 33%.

– PSG Namibia

[However,] there is still potential for the country to further capitalise on the growing luxury and eco-tourism trends through increased marketing efforts.

The prospects for high-end tourism are positive over the medium term as luxury goods surveys, such as the Saks Luxury Pulse survey, indicate that consumers are shifting their spending towards travel expenditures rather than luxury goods.

In the medium term, economic growth in key tourism partners of Namibia, including Germany, the US and France, is anticipated to accelerate, thereby enhancing disposable incomes and fostering increased international travel.

PSG Namibia anticipates a gradual decline in the average spot Brent crude oil price over the same period, which is likely to stabilise jet fuel prices and airfares.

Consumer shift

Travel to Namibia is dominated by personal, or leisure, travel as opposed to business travel.

Gitta Paetzold, chief executive of the Hospitality Association of Namibia (HAN), highlights in her remarks on the HAN Statistics for 2023 that the recovery of business and conference travel in terms of room occupancy has not matched that of the leisure travel market.

This can be explained by a shift in consumer preferences, as corporations in recent years have become more comfortable with virtual meetings and more conscious of their carbon footprint.

However, the Bank of Namibia’s (BoN) balance of payments data paints a different picture by showing that international business travel to Namibia in nominal local currency has bounced back.

While this is partly due to a weaker Namibia dollar, it also suggests that foreign business travellers to Namibia are spending more per capita.

Region

The HAN data also shows that the number of beds sold to travellers from Namibia and South Africa in 2023 was only at about 65% of the pre-pandemic level. (To some degree this is due to the lower number of participants in HAN’s survey.)

The weak numbers for local and South African visitors reflect real disposable income growth in these two countries.

South Africa’s economic growth is hampered by structural issues such as power shortages and congested ports, while Namibia’s economic non-mining growth is quite weak.

The HAN tourism accommodation figures seem to suggest that guests from the rest of Africa to Namibia are insignificant, accounting for one per cent of beds sold. However, this is not the case when looking at the data of the Ministry of Environment, Forestry and Tourism. This shows that over 82 000 Angolans, 25 000 Zambians and nearly 20 000 Batswana visited Namibia in 2022.

The discrepancy suggests that most Africans visiting Namibia are either staying in unregulated accommodations or with relatives, while some are also visiting as day visitors.

Europe, US

Europe as an anchor customer to Namibia’s travel industry presents an opportunity in itself, with its affluent travellers who are resilient to economic downturns.

Tourist arrivals from the European Union (EU) and the United States (US) have been robust.

According to Tourism Economics, pent-up savings during the pandemic and favourable exchange rates have encouraged overseas travel from these markets.

The European market is Namibia’s main source of tourism.

However, travellers from German-speaking Europe - Germany, Switzerland and Austria - traditionally dominate the local tourism market. Namibia has always enjoyed a steady influx of German tourists thanks to its colonial ties to Germany.

Recently, there has been a growing share of visitors from France and Italy, which are the two biggest economies in the EU after Germany. Moreover, France and Italy are effectively in the same time zone as Namibia, which is preferred by some travellers.

The return of Chinese tourists has been remarkably slow, due to China taking longer to lift its Covid-19 restrictions, as well as weakness in the Chinese economy.

Despite typically representing a minimal (1%-2%) share of accommodation bookings in Namibia, the number of beds sold to Chinese guests experienced a sharp decline, dropping from 21 317 in 2019 to 7 389 in 2023.

Popular North

According to the HAN, discussions with industry players suggest that the occupancy figures in the formal hospitality industry do not give a full account of the rising trends of self-drive and camping tourism in the country.

The HAN figures do show that lodges and rest camps sold the most beds in 2023, while tented camps and lodges had the highest occupancy rates.

Moreover, industry players also point to the high-end tourism market gaining popularity in Namibia.

These trends correspond with the global rise in glamping (glamorous camping) and underscore Namibia’s popularity as a destination for watching wildlife. Most of the country’s major wildlife parks are located in its northern region, including Etosha National Park, Bwabwata National Park and Mudumu National Park.

As a result, HAN data shows that most (37%) of the beds sold in Namibia are in the northern region.

Tourism accommodation bookings are evenly distributed among the rest of the regions thanks to each having plenty of unique attractions.

Among many others, the central region has the capital Windhoek and the Waterberg Plateau Park, the southern region has the Orange River and the Fish River Canyon, while the coastal region has Sossusvlei, Dune 7, Kolmanskop and the Skeleton Coast National Park.

Unlocking potential

In terms of unlocking more regional travel, Namibia and Botswana last February reached a landmark agreement to abolish the need for passports when citizens of both countries travel across the Botswana-Namibia border, provided they can produce their IDs at the crossing points.

The move – a first in Southern Africa – could help to promote travel between the two countries.

Furthermore, last September, Namibia launched its online tourist visa application service, which follows the implementation of the visa-upon-arrival pilot project launched in 2019.

Mining vs non-mining

Namibia has recorded exceptional economic growth rates, attributed to its surging mining activity.

Namibia’s mining sector grew by 51.4% year-on-year (y/y) in the first three quarters of 2023, while non-mining sectors only grew by 0.7% y/y. The current mining boom is mainly being driven by strong uranium and gold production and an unprecedented rise in oil and gas exploration activity.

Slow growth in agriculture, construction and manufacturing sectors mostly hampered non-mining gross domestic product (GDP).

The uptick in tourism activity, supporting hotels, restaurants and retail, is boosting non-mining GDP output.

Last year was the first full calendar year without any travel restrictions following the outbreak of Covid-19.

This paved the way for the Namibia Statistics Agency’s (NSA) arrivals index, which measures the level of regional, international and domestic passenger arrivals at Namibian airports, to finally reach pre-pandemic levels in the last quarter of 2023. A clear positive correlation exists between the arrival index and the NSA’s bed occupancy index.

Bigger role

A bigger role for tourism in Namibia would help to diversify the country’s reliance on mining and improve the resilience of economic growth and foreign exchange earnings.

Tourism service is currently Namibia’s fifth biggest export after diamonds, fish, gold and uranium.

Travel service exports accounted for only 8% of total goods and services exports in 2019 - the last year before the pandemic - while mining exports accounted for 39% and processed fish for 15% in the same year.

In 2019, travel and tourism are estimated to have directly contributed 5.6% to Namibia’s GDP, according to Tourism Economics, an Oxford Economics company.

Tourism Economics data also indicated that the Namibian travel and tourism industry supported 39 660 jobs directly in 2019. Although mining and quarrying contributed 10.4% to gross value added (GVA) in 2019, the sector only directly employed 16 432 jobs in the same year, according to the Namibian Chamber of Mines.

This underscores the fact that tourism generates more employment opportunities compared to mining. It also indicates that the tourism sector holds significant potential for fostering job creation in a country grappling with a high broad unemployment rate, which encompasses discouraged job seekers, reaching nearly 33%.

– PSG Namibia

Comments

Namibian Sun

No comments have been left on this article