Govt too reliant on personnel income tax – Hei

Economist Salomo Hei says government is too dependent on personnel income tax, and should look at ways to broaden the tax base.

He made the comments during a recent post-budget discussion held with lawmakers at Parliament.

“We are heavily reliant on personnel income tax and what is critical here is that you do not want to over-tax individuals, you do not want to kill the goose that lays the golden eggs. You want to create more taxpayers, you want to be able to have a bigger base of taxpayers,” Hei said of one of government’s most important revenue streams.

There is a need for government to look at other tax-related income streams, and not necessarily income tax, he added.

“Our income tax and obviously Southern Africa Customs Union [SACU] revenue is our main government revenue as we need to look at how we can diversify our tax basket."

Shift focus

Hei said the new tax measures announced in the recently-tabled budget may be sufficient to shift government’s focus away from personnel income tax and SACU revenues.

“We will see how the tax amendments will play out,” he said.

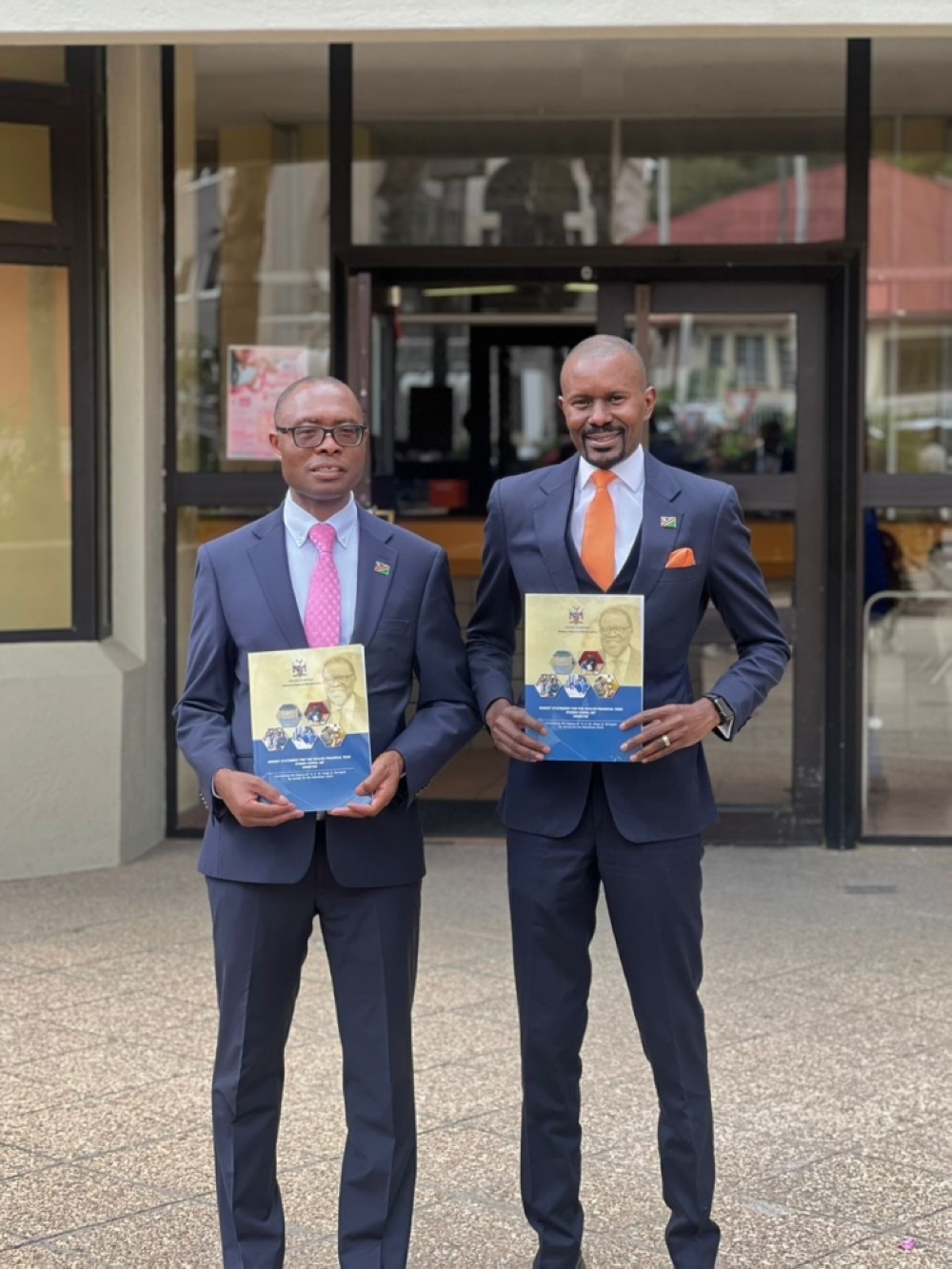

Finance minister Ipumbu Shiimi last week announced a revision to the threshold for income tax.

“We will increase the threshold for income tax on individuals from the current N$50 000 to N$100 000. This action will result in an injection of N$646 million directly into the pockets of taxpayers.” Effectively, all individual taxpayers will be exempted from paying tax on the first N$100 000 of their income as from 1 March.

Another measure announced is the introduction of a 10% dividend tax, to be introduced on 1 January 2026 to address the existing disparity in the investment arena where dividends paid to non-resident shareholders are subject to tax.

“These proposed reforms are expected to ensure revenue enhancement through improving corporate tax compliance and easing the administrative and audit burden on the Namibia Revenue Agency. Overall, the changes are estimated to yield additional taxes of more than N$600 million per annum,” Shiimi said.

He made the comments during a recent post-budget discussion held with lawmakers at Parliament.

“We are heavily reliant on personnel income tax and what is critical here is that you do not want to over-tax individuals, you do not want to kill the goose that lays the golden eggs. You want to create more taxpayers, you want to be able to have a bigger base of taxpayers,” Hei said of one of government’s most important revenue streams.

There is a need for government to look at other tax-related income streams, and not necessarily income tax, he added.

“Our income tax and obviously Southern Africa Customs Union [SACU] revenue is our main government revenue as we need to look at how we can diversify our tax basket."

Shift focus

Hei said the new tax measures announced in the recently-tabled budget may be sufficient to shift government’s focus away from personnel income tax and SACU revenues.

“We will see how the tax amendments will play out,” he said.

Finance minister Ipumbu Shiimi last week announced a revision to the threshold for income tax.

“We will increase the threshold for income tax on individuals from the current N$50 000 to N$100 000. This action will result in an injection of N$646 million directly into the pockets of taxpayers.” Effectively, all individual taxpayers will be exempted from paying tax on the first N$100 000 of their income as from 1 March.

Another measure announced is the introduction of a 10% dividend tax, to be introduced on 1 January 2026 to address the existing disparity in the investment arena where dividends paid to non-resident shareholders are subject to tax.

“These proposed reforms are expected to ensure revenue enhancement through improving corporate tax compliance and easing the administrative and audit burden on the Namibia Revenue Agency. Overall, the changes are estimated to yield additional taxes of more than N$600 million per annum,” Shiimi said.

Comments

Namibian Sun

No comments have been left on this article